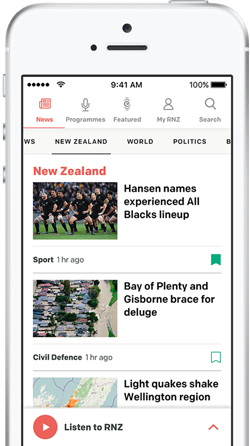

ANZ has seen more customers asking about switching from floating rate to a fixed one. Photo: RNZ

Home loan customers are hustling to fix as rates start to rise.

The country's biggest bank, ANZ, said it had seen more customers asking about switching from a floating rate to a fixed one in recent days.

More people have chosen floating rates in recent months, expecting interest rates would fall further.

October saw $51.6 billion in home loan lending floating, up from $47.9b the month before and $42.7b the previous October, but while the official cash rate was cut at the last update, retail home loan rates have started to rise.

The Reserve Bank indicated another OCR cut was very likely, whereas wholesale rates had almost completely priced one in.

- No Stupid Questions this week - You, me and the IRD Listen to No Stupid Questions with Susan Edmunds

The resulting adjustment in wholesale rates pushed up what banks were offering home-loan borrowers.

ANZ said it would encourage customers who wanted to fix to go through the app or email, via online banking.

Infometrics chief forecaster Gareth Kiernan said the reaction to the most recent monetary policy statement had been "overcooked".

"I think the governor's statement earlier this week backs up that view," he said. "We're still looking at the second half of next year, before fixed rates start trending higher across the board, although unless the recent spike in swap rates reverses out, expectations of the one- to two-year rates getting closer to four percent now look unlikely to be met.

"I'd also note that the four and five-year rates are likely to drift higher a bit sooner, although I still don't think there will be material lifts even in those rates before mid-2026."

Reserve Bank governor Anna Bremen. Photo: RNZ / Samuel Rillstone

Reserve Bank governor Anna Breman pushed back on markets on Monday, saying the forward path for the OCR published in the November MPS indicated a slight probability of another rate cut in the near term.

"However, if economic conditions evolve as expected, the OCR is likely to remain at its current level of 2.25 percent for some time," she said.

"Financial market conditions have tightened since the November decision, beyond what is implied by our central projection for the OCR.

"As always, we are closely monitoring wholesale market interest rates, and their effect on households and businesses."

Breman re-iterated that monetary policy was not on a preset course.

"This is why the MPC meets seven times a year to assess the latest economic conditions and forecasts."

ANZ economist David Croy said his broad view of where wholesale rates would go had not changed, despite the movement of recent weeks.

"2026 was always expected to be a year characterised by higher interest rates, especially in the two to five-year part of the swap curve."

He said the recent movements had brought forward some of the increase expected next year, but it was reasonable to think swap rates could fall a little over the coming weeks, as markets digested Breman's comments, which could take some pressure off.

"The holiday season often brings out investors chasing carry and few global markets offer the same degree of carry as the New Zealand market."

Sign up for Money with Susan Edmunds, a weekly newsletter covering all the things that affect how we make, spend and invest money