If you have bad credit, you might be wondering whether a bank will ever be willing to give you a home loan.

A person's credit score reflects how well they had paid off credit in the past and how likely they are to be able to service their debts in the future.

It takes into account factors like how long you have had credit accounts - that could also include things like power and internet bills - how often you make your payments on time, how much you owe on loans and credit cards, what types of credit you have, how often you ask for credit and any defaults or insolvencies in your history.

There are three different credit bureaux in New Zealand but, for all of them, the lower your score, the poorer your credit rating.

Centrix ranged from zero to 1000.

It said anything below 496 was poor and about 10 percent of the population was in that range. Centrix noted people in this bracket were more likely to be rejected for a loan.

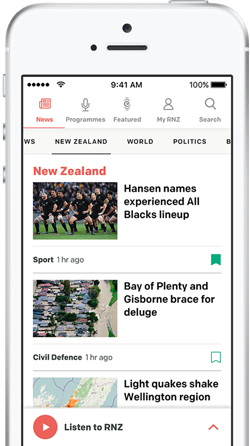

Missed power or phone bills could sometimes impact a person's credit score. (File photo) Photo: Shutterstock / Allie Schmitz

People with slightly better scores might get a loan but have extra conditions.

For example, anything below 299 is low and 300 to 499 represented "room for improvement".

David Cunningham, chief executive at mortgage advice firm Squirrel, said about 420 was the level at which banks would draw a line.

"Some people's scores are way lower than expected. The biggest thing we see is missed minimum payments on credit cards over several months.

"One-off has a negligible impact. It's when it becomes a deteriorating trend."

He said people also needed to watch out for power bills and phone bills.

Sometimes a missed payment could affect someone's credit without them realising, for example if they had moved house and not paid a final bill.

But he said banks were generally open to an explanation if people could provide information about how they got into trouble.

Another mortgage adviser, Jeremy Andrews at Key Mortgages, said it was a "blurry line" that borrowers did not want to push too far.

"A score of 400 to 500 trending upward with good recent conduct might be better than a score of 500-plus with recent bounced payments or dishonours, unarranged overdraft fees. Any recent collection steps or agencies having to step in will be much harder to mitigate."

He said other things could be easier to fix or explain.

"Historical events affecting credit scores such as not paying bills on time, or just tipping into arrears, could be a short term problem and easily fixed. But if a borrower has not been paying either financial companies or property related bills such as property rates, on time every time, that can be a much bigger problem to resolve."

Head of Link Advisory Glen McLeod said banks had internal thresholds.

"That said, it's not just about the score itself. Lenders look at the full picture: what kind of credit issues are showing up, how recent they are, and what caused them.

"Life events-like a separation, illness, or unexpected financial hardship-can reflect on your credit score, even if they were temporary. That context matters and can influence how a lender views your application.

"If the credit history is too risky for a mainstream bank, non-bank lenders may still be an option. They tend to be more flexible, though that usually comes with higher interest rates to reflect the added risk."

Sign up for Ngā Pitopito Kōrero, a daily newsletter curated by our editors and delivered straight to your inbox every weekday.